Imprint Petaling Jaya Selangor Darul Ehsan. Sole distributor Golden Books Centre 2002.

History Of Aarvam Social Services History Poverty

Oil Taxation Act 1975 1975 CHAPTER 22.

. Title Service Tax Act 1975 Act 151 regulations and order. To make in the law relating to income tax and corporation tax amendments connected with such. Reviews 0 Reviews There are no reviews yet.

8 of 2009 Act No. Added Corporate Author International Law Book Services. International Law Book Services.

Decided January 30 1975. The primary goals of EPCA are to increase energy production and supply reduce energy demand provide energy efficiency and. When it became obvious that the five municipalities were not complying with the order a prerogative writ suit was commenced on January 21 1974 to.

Superior Court of New Jersey Appellate Division. The persons mentioned under the heading for Taxable Person in Groups A B1 B2 C D E E1 F and G of this Schedule providing any taxable service under the heading for Taxable Service in each Group shall apply for a license provided that where 2 or more licenses are required. Title Service Tax Act 1975 Act 151 regulations and order.

110 1975 348 A2d 195. 871 enacted December 22 1975 is a United States Act of Congress that responded to the 1973 oil crisis by creating a comprehensive approach to federal energy policy. Carteret South Amboy and their respective tax assessors to make a complete revaluation of all taxable real property within each municipality to be effective in 1975.

Table for Taxable Persons and Services Second Schedule To The Service Tax Regulations 1975 1. Akta Cukai Perkhidmatan 1975 by Malaysia 2002 International Law Book Services Sole distributor Golden Books Centre edition in English Service Tax Act 1975 Act 151 regulations and order 2002 edition Open Library. An Act to impose a new tax in respect of profits from substances won or capable of being won under the authority of licences granted under the Petroleum Production Act 1934 or the Petroleum Production Act Northern Ireland 1964.

Service tax is an ad valorem tax is imposed by the Government of Malaysia on certain taxable services provided by taxable persons. As at 5th September 2002 compiled by Legal Research Board. The Service Tax Act 1975 Act 151 which makes provision for the charging levying and collecting of service tax came into force on March 1 1975.

B 521975 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara and Dewan Rakyat in Parliament assembled and by the authority of the same as follows. Submitted September 23 1975. SERVICE TAX ACT 1975 ACT 151 REGULATIONS AND ORDER.

Service Tax Act 1975 Act 151 regulations and order Close. The Service Tax Act 1975 Act 151 which makes provision for the. Services listed below are free from Service Tax.

Decided November 10 1975. An edition of Akta Cukai Perkhidmatan 1975 2000 Service Tax Act 1975 Act 151 regulations and order as at 25th February 2000 by Malaysia. Act 151 SERVICE TAX ACT 1975 An Act to make provision for the charging levying and collecting of service tax.

Exemption of Service Tax is only given by The Minister of Finance as under section 6 service tax Act 1975. Added Corporate Author International Law Book Services. The Energy Policy and Conservation Act of 1975 EPCA PubL.

JOHN SCOTT AND LILLIAN SCOTT DEFENDANTS-RESPONDENTS. Be the first to review SERVICE TAX ACT 1975 ACT 151 REGULATIONS. 0 Ratings 1 Want to read.

1 March 1975 PU. The Service Tax Act 1975 is applicable throughout Malaysia except in Labuan Langkawi Tioman Free Zones and Joint Development Area JDA. Therefore taxable service provided by a taxable person to a person in a country.

HOUSING AUTHORITY OF THE CITY OF NEWARK PLAINTIFF-APPELLANT v. Provision or sale of food drinks or tobacco products by Second and Third Class Public Houses and Second Class Beer House effective from 30 April 2001. As at 25th February 2000 compiled by Legal Research Board.

Gst In Textile Sector What You Should Know 20 Faqs

Interest Under Section 50 Of Cgst Act 2017

Income Tax Act Section 28 Legodesk

Maharashtra Profession Tax Act

First Information Utility Set Up Under Ibc Https Taxguru In Corporate Law Information Utility Set Ibc Html Corporate Law Ibc Corporate

Usps Seal Of Delivery Several Logos Mottos Have Represented Usps Through The Years Postal Service Logo Loom Beading Logo

Income Tax Act Section 28 Legodesk

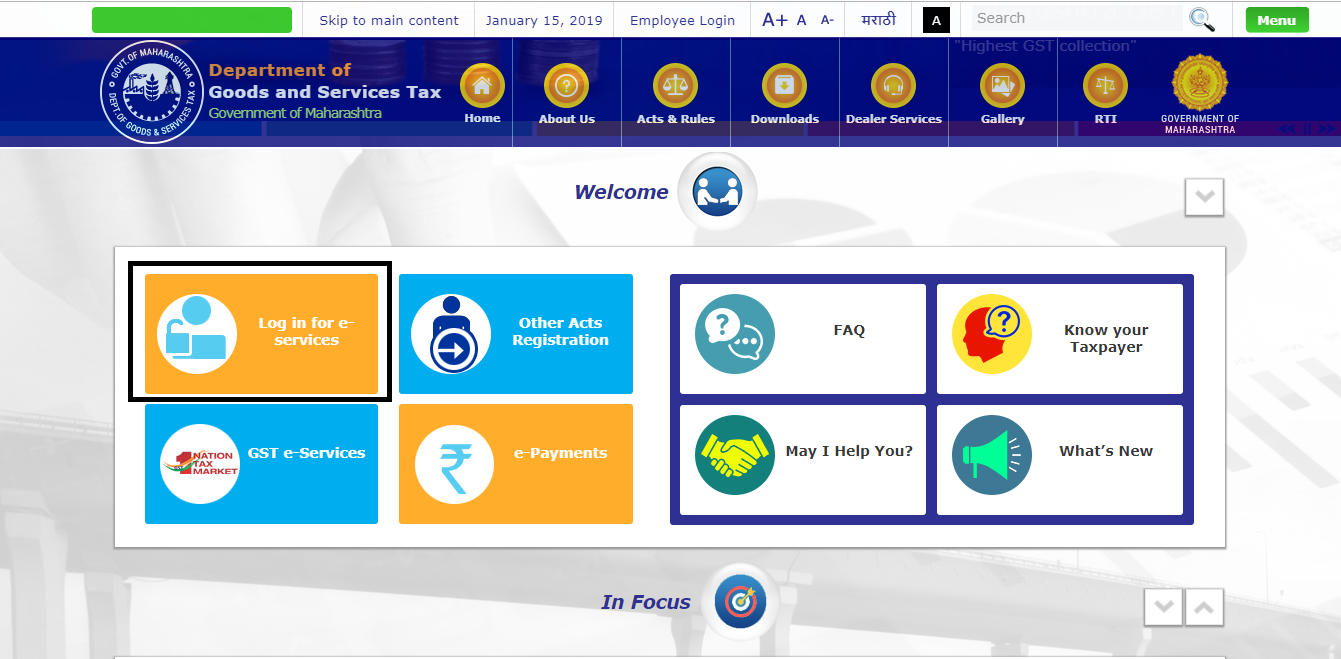

Get Enrollment Certificate For Profession Tax Maharashtra How To Register

Anti Dumping Investigation Of Hot Rolled Flat Products Of Alloy Or Non Alloy Steel Http Taxguru In Custom Duty Anti Dum Investigations Corporate Law Custom

What Is Professional Tax Meaning Rates Applicability Who Levies It

Lumbar X Ray Report Template 1 Professional Templates Report Template Templates Sample Resume

Know How To Respond To Assessment And Reassessment Notice Under Section 148 Of The Income Tax Act

All About The Valuation For Customs Duty Under Customs Act Taxmann

Kerala Building Tax Act Kbt Exemption Of Tress Work In Zero Land